Rodolfo. C. Balmater

Chairman

His profile is available under the Board of Commissioners’ Profile section.

Pursuant to the applicable laws and regulations, the GCG implementation within the Company observes the principles of Transparency, Accountability, Responsibility, Independency, Fairness, and Equality.

The Company applies the Transparency principle by disclosing relevant and accurate information to shareholders and stakeholders in a timely manner by regularly and periodically publishing Financial Statements, Annual Reports, and other material information, and provides means to access the Company’s important information through the Company’s corporate website, print media and press releases, investor meetings, public exposes, and press conferences.

The Company applies the Accountability principle by ensuring the availability of charters needed by the Company’s main bodies to provide clarity of function, implementation and accountability pertaining to shareholders, Board of Commissioners, Board of Directors, Committees, and Corporate Secretary in order to ensure effective implementation of corporate governance.

The Company applies the Responsibility principle by observing applicable capital market provisions that include taxation, healthy competition, industrial relations, occupational health and safety, payroll standard, as well as other relevant regulations.

The Company applies the Independency principle by ensuring that each business unit operates independently without dominating each other and without interference from other parties. In addition, every decision is made professionally and objectively, free from conflicts of interest, and in a respectful relationship between the Company’s bodies and business units.

The Company applies the Fairness principle in various operational aspects, including by honoring the rights of minority shareholders. The Company applies the Equality principle by ensuring that the rights of shareholders and stakeholders can be fulfilled properly in accordance with the prevailing agreements and laws. The Company also provides equal opportunities in the recruitment and human resources management without discrimination based on ethnicity, religion, race, class, gender and physical condition.

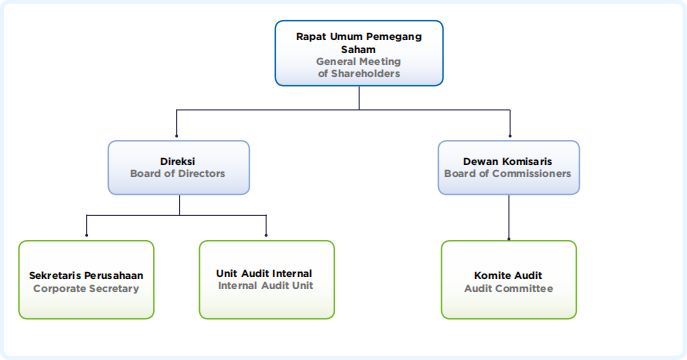

The Company’s GCG Structure was established to accommodate the systematic implementation of GCG with clear division of roles and responsibilities. In accordance with Law No. 40/2007 on Limited Liability Companies, the Company is equipped with Corporate Governance Structure consisting of the General Meeting of Shareholders, the Board of Commissioners and its supporting body namely Audit Committee, as well as the Board of Directors and its supporting bodies namely Corporate Secretary and Internal Audit Unit.

As the holder of the highest power in the management

structure, General Meeting of Shareholders (GMS)

possesses the authority not given to the Board of

Commissioners and the Board of Directors including

the decision-making on the amendment of the Articles

of Association, merger, consolidation, acquisition,

bankruptcy and dissolution of the Company. In general,

the aforementioned authority is governed and limited by

the Law No. 40/2007 on Limited Liability Companies, as

well as the Company’s Articles of Association.

The Company holds GMS in accordance with OJK

Regulation No. 15/POJK.04/2020 on the Plan and

Implementation of the General Meeting of Shareholders

of Public Companies. The GMS’ resolutions are made

by taking into account the Company’s long-term

business interests. In exercising its authority, the GMS

must pay attention to the Company’s rights, interests,

development, and health; as well as stakeholders’ rights.

The Board of Commissioners is a supervisory body

responsible for overseeing all managerial actions taken

by the Board of Directors and performing special

duties assigned by the GMS. In addition, the Board of

Commissioners monitors the implementation of good

corporate governance within the Company as well

as compliance with applicable laws and regulations.

Moreover, the Board of Commissioners also performs

consulting function and may also advise the Board of

Directors.

In performing its duties and functions, the Board

of Commissioners is equipped with the Board Of

Commissioners’ Charter as its work guidelines and

procedures. Likewise, the Board of Commissioners is

assisted by the Audit Committee.

The Company currently has no special committee to

perform nomination and remuneration functions as

those functions have been performed by the Board of

Commissioners. This is allowed in accordance with the

provisions of the OJK Regulation No. 34/POJK.04/2014

on Nomination and Remuneration Committee of Listed

or Public Companies.

The procedures for the determination of remuneration

structure, policies, and amount for members of the

Board of Directors and Board of Commissioners have

been disclosed under the Board of Commissioners and

Board of Directors Remuneration section of this Annual

Report.

In performing its supervisory function, the Board of Commissioners maintains its independence without intervention from other parties that may affect its objectivity and independence. Moreover, pursuant to OJK Regulation No. 33/ POJK.04/2014 on Listed or Public Companies’ Board of Directors and Board of Commissioners, 2 members or 30% of the Board of Commissioners are independent. Independent Commissioners are members of the Board of Commissioners from outside the Company, have no affiliation with the Company, appointed in a transparent and independent manner, have integrity and competence, free from influences related to personal or other parties’ interests, and able to act objectively and independently in accordance with GCG principles.

Performance Assessment

The Board of Commissioners’ performance is evaluated through self-assessment by members of the Board of Commissioners. The self-assessment criteria are as follows:

The Board of Directors is an executive body responsible

for directing the affairs of the Company that include

strategy planning and preparation; operations,

administrations and other supporting activities;

accounting and reporting of operations through financial

statements; as well as management reports and other

reports.

In performing its roles and functions, the Board of

Directors is equipped with the Board Of Directors’

Charter as its work guidelines and procedures. Likewise,

the Board of Directors is assisted by the Internal Audit

Unit and the Corporate Secretary.

In general, the duties and responsibilities of the Board Directors are as follows:

Performance Assessment

The Board of Directors’ performance assessment is conducted internally or self-assessment by the Board of Commissioners to be presented at the General Meeting of Shareholders. In general, the Board of Directors’ performance assessment is based on, but not limited to, the following criteria:

The Audit Committee is a supporting body that assists the Board of Commissioners in performing its supervisory function on matters related to financial statements, internal control system, the efficacy of audits performed by external and internal auditors, the efficacy of risk management implementation, as well as compliance with applicable laws and regulations. The Audit Committee performs its duties and responsibilities in accordance with the Audit Committee’s Charter and answers directly to the Board of Commissioners.

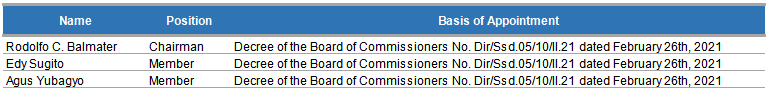

The Audit Committee is appointed in accordance with OJK Regulation No. 55/POJK.04/2015 on the Establishment and Work Guideline of the Audit Committee. The composition of the Company’s Audit Committee as of March 31st, 2021, is as follows:

Rodolfo. C. Balmater

Chairman

His profile is available under the Board of Commissioners’ Profile section.

Edy Sugito

Member

Indonesian citizen, born in 1964, obtained his Bachelor of Accounting degree from Trisakti University, Jakarta, in 1991.

Concurrently serves as Independent Commissioner

of PT PP London Sumatra Indonesia Tbk (since 2012),

Independent Commissioner of PT Wismilak Inti Makmur

Tbk (since 2012), Commissioner of PT Gayatri Kapital

Indonesia (since 2013), Independent Commissioner of

PT Dharma Satya Nusantara Tbk (since 2013), Independent

Commissioner of PT Trimegah Sekuritas Indonesia

Tbk (since 2013), and Independent Commissioner of

PT Soechi Lines Tbk (since 2014).

Previously held various positions in numerous companies

including Senior Auditor at Arthur Andersen (Drs.

Prasetio, Utomo & Co.) (1989-1991), Operations Manager

of PT ABN Amro Asia Securities (1994-1997), Associate

Director of PT Bahana Securities (1997-1998), Director

of PT Kustodian Sentral Efek Indonesia (1998-2000),

Director of PT Kliring Penjaminan Efek Indonesia (2000-

2005), and Director of Listing of PT Bursa Efek Indonesia

(2005-2012)

Agus Yubagyo

Member

Indonesian citizen, born in 1964, Certified Public Accountant (CPA) in Indonesia, obtained his Bachelor of Accounting Degree from Universitas Pembangunan Nasional (UPN Veteran) Negeri in 1988.

Previously held various positions in several companies such as Audit Manager of

KAP Prasetio, Utomo & Co. (1988 – 1999), Operations Director of PT Ceka Jawa Indonesia

(1999 – 2001), Audit Partner of KAP Tanzil & Co. (IGAF) (2001 – 2002),

Finance Director and Corporate Secretary of PT Zebra Nusantara Tbk. (2002 – 2004),

Audit Partner of KAP Paul Hadiwinata, Arsono & Co., (PKF) (2004 – 2006), various positions

(Internal Audit Head, Corporate Secretary, Business Development Head, Merger & Acquisition Project Head, Treasury Head,

Staff to the CEO) in various companies of Trisakti Group (PT Trisakti Purwosari Makmur, PT Sentosa Abadi Purwosari,

PT Purindo Ilufa, PT Mandiri Maha Mulia and PT KT&G Indonesia) (2006 – 2018), and Director of PT Indo Media Universal Group (2019 – 2020).

The Audit Committee is chaired by an Independent Commissioner with two members consisting of professionals from outside the Company. The Audit Committee performs its function and responsibility without interference from other parties. Audit Committee members are not related to Shareholders, Board of Commissioners, or Board of Directors. In addition, Audit Committee members from outside the Company do not have personal interests/relationships that can have adverse impact on and cause conflict of interest with the Company.

The Audit Committee’s duties and responsibilities are providing the Board of Commissioners with opinions regarding reports or other matters submitted by the Board of Directors, identifying matters that require the attention of the Board of Commissioners, and performing other tasks related to the Board of Commissioners’ duties, as follows:

The Company is committed to continuously improving

its internal control system on all its business processes.

The Boards of Commissioners and Directors and management consistently raise employees’ awareness

about strict compliance to the Company’s policies and

procedures. The Company’s authorization matrix defines

the assignment of authority, responsibility and limits over

certain transactions and activities. In addition, proper

segregation of duties is observed through all levels of

organization.

The effectiveness of internal controls is continuously

monitored by the Company’s internal auditors. Significant

findings are immediately reported to the management

and Audit Committee. Appropriate sanctions are

imposed after due process.

Internal Audit Unit is the Board of Directors’ supporting

body that assists the management in providing

independent and objective assurance and advise to

improve the Company’s operational activities through

a systematic approach by evaluating and improving the

effectiveness of risk management, internal control and

governance process.

The Company established the Internal Audit Unit in

accordance with OJK Regulation No. 56/POJK.04/2015

on Internal Audit Unit Establishment and Charter

Preparation Guideline. In performing its duties and

responsibilities, the Internal Audit Unit observes the

Internal Audit Unit’s Charter.

The Internal Audit Unit is led by the Internal Audit Unit Head. The Internal Audit Unit administratively answers to the President Director and functionally to the Audit Committee. The Internal Audit Unit Head is appointed and dismissed by the President Director with the Board of Commissioners’ approval. Members of the Internal Audit Unit answer directly to the Internal Audit Unit Head.

David Roganda SE, Ak

Indonesian citizen, born in 1976, obtained his Bachelor

of Accounting degree from the Economic Faculty of

Padjajaran University, Bandung. Appointed Internal Audit

Unit Head in accordance with the Board of Directors’

Decree No. Dir/Ssd.09/24/III.18.

Previously served as Auditor at Joseph Munthe Public

Accounting Firm (2000-2005), Accounting Supervisor

at PT Pama Persada (2005-2009), and Internal Audit

Manager at Goodhope Agro (2009-2013).

The Company has established Code of Conduct in accordance with the Decree of the Board of Directors of PT Madusari Murni Indah Tbk No. Dir/Ssd.21/59/ XII.20 on the Corporate Code of Conduct of PT Madusari Murni Indah Tbk and Subsidiaries (Molindo Group) dated December 29th, 2020.

The Code of Conduct was prepared in accordance with the following applicable laws and regulations:

The Company’s Code of Conduct regulates, among others, the following matters:

The Code of Conduct has been disseminated to all members of the Company at all organizational levels. The dissemination was conducted through new employee orientation program, distribution of booklets, as well as other activities and other media owned by the Company. In addition, all members of the Company have implemented the Code of Conduct in a consistent and responsible manner.

The Company is equipped with whistleblowing mechanism for violations committed internally within the Company by the Company’s bodies or employees through the Human Resources Division. Whistleblowers’ identity is kept confidential to protect them from threats, harassments, and retaliations. The investigation into the reported violations and subsequent imposition of sanctions are conducted in accordance with the Company’s regulation and the prevailing laws and regulations.

Kantor Akuntan Publik Kosasih, Nurdiyaman, Mulyadi, Tjahjo & Rekan (Crowe Indonesia)

Cyber 2 Tower Lt. 9 Unit A, B, C, Jl. Rasuna Said blok X-5 No. 13 Kuningan Timur, Setiabudi,

Jakarta Selatan - DKI Jakarta 12950

(021) 22836086

PT Adimitra Jasa Korpora

Kirana Boutique Office Blok F3 No. 5. Jl. Kirana Avenue III, Kelapa Gading Jakarta Utara 14240

021-2974 5222

021-2928 9961

The Company’s activities are exposed to various financial

risks such as market risk (including foreign exchange

rate risk, price risk and interest rate risk), credit risk and

liquidity risk. The Company’s overall risk management

program is focused on unpredictable financial markets

and the Company strives to minimize the effects that

have the potential to harm financial performance.

The Company uses various methods to measure the risks

it faces. This method includes sensitivity analysis for

interest rate risk, exchange rates and other price risks.

Foreign Exchange Rate Risk

The Company is exposed to foreign exchange risk arising from various currency exposures. Foreign exchange risk arises from future commercial transactions and recognized assets and liabilities. Management has established a policy that requires the Company to manage the risk of foreign exchange rates against its functional currency.

Price Risk

The Company is exposed to price risk, mainly due to purchase of molasses which is the main material. The molasses price is affected by several factors, such as demand and supply. The effect of price risk results to an increase in production cost.

Interest Rate Risk

The Company’s exposure to interest rate risk is mainly related to loans and interest-bearing assets and liabilities, such as bank loans. The Company’s policy is to get the most favorable interest rates.

The Company has credit risks that mainly come from

deposits in banks, credits given to customers, and other

receivables. The Company manages credit risk associated

with deposits in banks by monitoring reputation and

limiting the aggregate risk to any individual counterparty.

With regard to credit exposure given to customers,

most of which come from sales activities, the Company

monitors the credit portfolio on an ongoing basis and

manages the collection of receivables to minimize credit

risk.

There is no concentration of credit risk as the Company

has diversified its portfolio to various customers.

There has been no history of significant defaults from

customers.

Liquidity risk is a risk wherein the Company may not

be able to meet its current obligation. Prudent liquidity

risk management includes managing the profile of

borrowing maturities and maintaining sufficient cash and

cash equivalents, and ensuring the availability of funding

from an adequate amount of committed revolving credit

facilities.

The Company’s ability to fund its borrowing requirements

is managed by maintaining diversified funding sources

with adequate committed funding lines from high quality

lenders and by monitoring rolling short-term forecasts of

the Company’s cash and debt on the basis of expected

cash flows.

In addition, the Company monitors the timely collection

of its trade receivables on weekly basis and immediately

sends reminder to customers for any delay in payment.

The Company identifies and evaluates risks through each department. The Board of Directors together with the Internal Audit Unit and the Board of Commissioners represented by the Audit Committee conduct a study and formulate the management and mitigation strategies needed. In addition, the risk management system implemented by the Company is able to mitigate any possibility of risk occurrence.

The amount of remuneration for the Board of Commissioners, the Board of Directors, and the Audit Committee is determined based on key performance indicators as well the Company’s financial condition. The Annual GMS authorizes the Board of Commissioners to determine the remuneration of the Board of Directors, the Board of Commissioners, and the Audit Committee.

Pursuant to Financial Services Authority Regulation No. 35/POJK.04/2014 on Corporate Secretary of Listed or Public Companies, the Board of Directors had appointed Jose G. Tan who domiciled in Jakarta as Corporate Secretary in accordance with the Decree of the Board of Directors No. Dir/JKT.MMI/01/VII.19 dated July 31st, 2019.

Jose G. Tan

His profile is available under the Board of Directors’ Profile section.

The duties and responsibilities of Corporate Secretary are as follows: